Insurance is a formal agreement bound by law whereby a party is assured of future financial security or repayment/refurbishment in case of unexpected damage by an insurance company. To help reduce the payment load from their customers, the companies use risk pools to lessen the cost. In case damage occurs to the insured product, there are laws put in place to shield the individual or business from financial breakdown as a result of the damage.

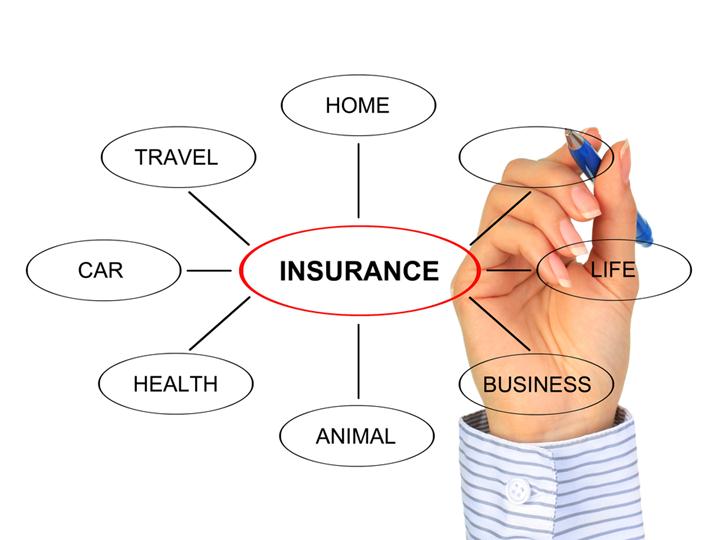

Types of Insurance

Insurance companies have worked to develop various options for their customers, whether businesses or individuals, a platform with several insurance policies are available for them to choose from. Policies such as auto, health, and life are the most common in the market; some are supported by the government, for instance, auto insurance in the United States.

When it comes to businesses, the policies differ since each business will partake in a policy that serves its own purpose and benefit. To give an example, a beauty salon owner may insure against damage that may result from using electrical equipment but a motorcyclist cannot insure on the same but on either accidents or theft. There are also other policies for other incidences, such as medical malpractices or even kidnap.

Elements of an Insurance Policy

Before you choose the type of insurance policy, you would want to first understand the different types of insurance and how they work. These elements include premium, policy limit, and deductible. Once you have understood all these elements, it will be a walk over when trying to find the best insurance policy that works for you.

A policy’s price tag is what is referred to as the premium. The insurance company or the insurance determines how much the policy you have chosen is going to cost you. This is determined in accordance to your ‘risk profile’. For a case of a person with an expensive business but is reckless in maintaining it is highly likely to have a higher premium compared to a person with the same business but is careful in protecting the business. However, the premium varies for different insurers, which is why it is advised that you read up on the details.

For a given policy, there is a maximum limit to which the insurer is going to repay you back to cover the losses; this is what is referred to as policy limit. In this case, the higher the policy limit the higher the premium to be paid is. To set these maximum amounts, companies may use periods (i.e per month or annually).

Before an insurer pays for a claim, there is a small amount of money that the policyholder is supposed to pay; this is what is referred to as the deductible. Deductibles vary in comparison to different policies and different insurers. A higher deductible paid results in a lower policy cost since they work to balance one another.

Featured Image: depositphotos/Rawpixel