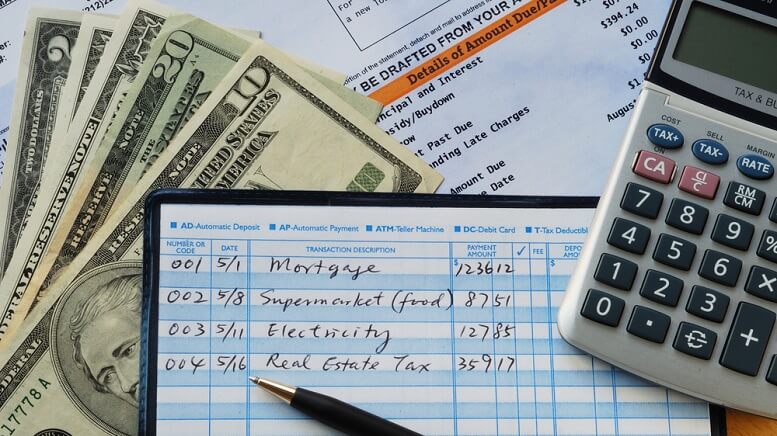

Credit cards are necessary to use sometimes, but other times, people opt for personal loans instead. There are several benefits of doing so, with personal loans able to pay off educational fees, debt, travel, car financing, home improvement, and even wedding expenses. The process of obtaining a personal loan is not smooth sailing; individuals must understand the loan terms before committing. For instance, when looking into personal loans, individuals should choose one with a reasonable interest rate, and the only way you’ll get this type of loan is if you have a good credit score. If you don’t, you might want to stick to using your credit card, as interest rates could be even higher.

If the latter doesn’t apply to you, there’s more you should about personal loans.

Obtaining a Personal Loan: What Should You Know

Did you know there are two types of personal loans? The first is a secured personal loan; the second is an unsecured personal loan. The former means an individual has indicated something as collateral, such as a house, car, or boat, in case they do not repay the loan on time. The good thing about secured loans is that they have lower interest rates than unsecured personal loans. However, if you neglect to repay it on time, you will not get your collateral back. Unsecured loans are also called signature loans, as the lender needs the signature of the individual to be repaid.

It’s also important to know who the lender of the personal loan will be before obtaining one. Banks and credit unions offer them, but if you go to a bank, make sure it’s the one you normally do business with. There are benefits of this, such as your bank being more willing to give you an unsecured loan. Before committing, it’s important to call around, comparing terms of conditions and interest rates between various lenders, and never give a loan application until you’re 100% on a lender. We say this because when you apply, the lender checks your credit score, and if this is done too many times, it could lower your credit score.

Aside from banks and credit unions, individuals can look online for personal loans from P2P websites; some sites offer personal loans up to $25,000 if you have a good credit score. If this sounds like the route you want to take, but you don’t know your credit score, contact a credit reporting bureau.

Featured image: DepositPhotos – johnkwan