SurePayroll provides payroll services for both small as well as medium-size businesses. It has also developed a competent management system in its small business payroll software known as One-Click Payroll. This system allows for a much faster payroll process, thus minimizing the number of hours it could have taken for you to so the payroll on your own. Nevertheless, this system works well only when the amount paid will be the same from one pay period to the next. In the case of a pay amount that will frequently change, the One-Click Payroll should be turned off.

Getting Around

SurePayroll has gone through several user interface changes over the past few years. It currently has a lighter and more contemporary feeling even though it is still a bit crowded and busy. The site ranks high in terms of design. The site looks more appealing and uniform than what it looked like a few years ago.

Navigation is quite similar to the previous iteration. SurePayroll normally opens to a Dashboard that contains navigation and visual links. It displays a total of 5 other tabs for the website’s main sections: Payroll, Employees, Company, Reports and Resources (like reminder preferences, year-end info and enrollment forms). Click on one and the multi-item menu contains a series of tasks that can actually be accomplished there. Every payroll service for small business competitor employs a similar layout so as to deliver a superior user experience.

The working screens in SurePayroll normally use a combination of drop-down lists, blank fields, multiple-choice buttons, hyperlinks and interactive bars for navigation and data entry. When you are entering or editing employee or company information, the website will display a vertical toolbar on the left hand side that enables you to quickly locate the screen that you need. For instance, the company page includes things such as Schedule, Earnings, Benefits and Hourly Rates for easy access. This type of navigation scheme is also used by other cloud-based financial apps and small business payroll is no exception either. Even though it is not innovative, it’s still fast and effective, and it will be understood easily by any person who has run payroll on a similar service over the past few years.

The Main Event

Once you have set up everything for your first business payroll, it’s dashboard will most likely be your next destination. All the information about your present payroll appears on the upper left corner: the pay period start, end as well as check date, the payroll deadline (this is the most prominent time/date on this page), and a large orange button that states, Continue Payroll. Directly below it is a summary of the most recent payroll including all outstanding action items (such as a link that could be a little bit more prominent).

Other content includes a customizable chart displaying payroll snapshots and trends, reminders and links to the off-cycle activities such as additional checks. The page is more informative than and not as busy as other payroll service for small business providers.

Paying employees and taxes

You can decide to pay all your employees via check or direct deposit. If your employees would prefer being paid by check, then you can decide to print them by yourself from your printer or even have SurePayroll printing and then mailing them to you. Nevertheless, if you opt to have SurePayroll printing and mailing checks, it will costs you an additional charge every time.

There’s no option for paying your employees with the pay cards.

This small business payroll software makes it easy for people to run payroll while on the go thanks to its smartphone application for either Apple or Android mobile devices. In addition, employees can also use this smartphone application to access a wide range of information like their paychecks, personal time, available vacation and pay stubs.

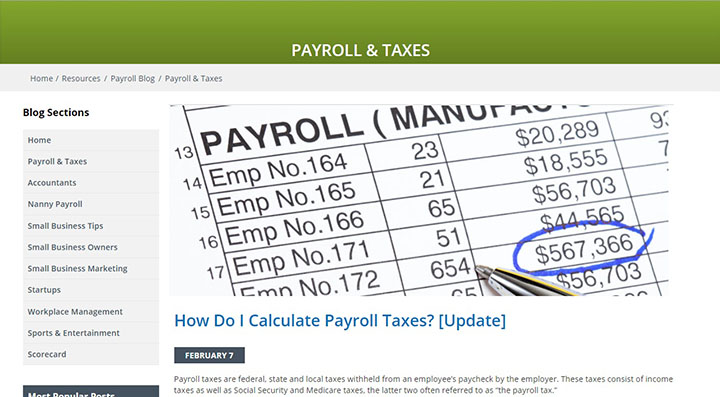

You do not have to be stressed about staying compliant on the payroll taxes with this company’s small business payroll processing services. As a matter of fact, SurePayroll automatically takes good care of them. This payroll service for small business can also take care of your year-end W-2 processing. Nevertheless, you should realize that this will cost you an additional fee. You can still review the tax information before it is filed. Furthermore, you can print additional forms in case any of your employees happens to misplace his/her copies.

Pros

· SurePayroll features an interactive and customizable dashboard that will give you a better experience as compared to other small business payroll software.

· It also supports several payroll types.

· SurePayroll has excellent payroll-processing and recordkeeping tools.

· This payroll service for small business can also calculate and submit payroll taxes.

· SurePayroll allows people to process their payroll in just a single click.

Cons

· SurePayroll has poor customer service as compared to other small business payroll software.

· It also has incompetent end-of-year reports as well as local filing.

· The crowded interface might be quite difficult to navigate at times.

· There’s no free trial thus you can’t test the reliability of their service.

· SurePayroll does not have the option of using pay cards so as to pay employees.

Customer service

If you ever find yourself in need of any help on your payroll or even when you have questions, you can always contact a representative using different ways. SurePayroll is always available via phone, live chat and email. However, their live chat feature is not available on Sunday.

This payroll service for small business also has an online support library that you can access easily using your online account. Besides that, you can also reference their 10 FAQs that cover a number of topics. In addition, SurePayroll has a wide range of videos on payroll and the payroll taxes on its site. This small business payroll solution is compatible with all the other major accounting software, including Sage 50, QuickBooks and Quicken.

Summary

SurePayroll has been tried and proven to be true. This is an exceptionally rich payroll service for small business that has grown quickly over the past few years to provide the detail, customer service and flexibility that small businesses require from payroll software. The company makes processing your payroll to be quick with the One-Click Payroll that will allow you to process your employee’s payroll in one click provided your payroll remains the same every time. With great tax services and several pay options, SurePayroll can offer a lot of services for businesses

Featured Image: surepayroll